1. Executive Dossier Summary

Company: Wayfair Inc.

Jurisdiction: United States (Headquarters: Boston, Massachusetts)

Sector: E-Commerce / Logistics / Home Goods Retail

Leadership: Niraj Shah (CEO, Co-Founder, Co-Chairman), Steve Conine (Co-Founder, Co-Chairman)

Intelligence Conclusions:

Finding 1: Structural Ambivalence and Commercial Facilitation The forensic assessment classifies Wayfair Inc. not as a primary ideological architect of the occupation, but as a critical “Commercial Facilitator” characterized by “Structural Ambivalence.” The company maintains a “Neutrality Doctrine” that prioritizes revenue and “lawful” commerce over international human rights standards.1 This operational posture creates a permissible environment where goods produced in illegal West Bank settlements—specifically by the Keter Group and Ahava—are retailed to North American consumers without ethical friction or transparency.3 Wayfair’s proprietary logistics network, CastleGate, acts as an opacity engine, obscuring the origins of these goods and integrating them seamlessly into the domestic supply chain, thereby normalizing the economic output of the settlement enterprise.3 Unlike a passive marketplace, Wayfair assumes the role of “Importer of Record” for many of these goods, taking legal and logistical custody of settlement products and essentially laundering their origin before they reach the American consumer.

Finding 2: Strategic Dependency on the “Unit 8200” Digital Stack While Wayfair does not manufacture weaponry, its digital infrastructure is structurally dependent on the Israeli defense-technology sector. The audit reveals a deep, multi-layered reliance on the “Unit 8200 Stack”—a suite of cybersecurity and operational technologies developed by veterans of Israel’s elite military intelligence unit. Wayfair’s critical systems for network security (Check Point), cloud visibility (Wiz), identity management (CyberArk), and fraud prevention (Riskified) are all sourced from Israeli firms.4 This is not merely an incidental purchase of software; it represents a strategic subsidy. Wayfair transfers millions of dollars in annual recurring revenue (ARR) to these firms, directly funding the R&D pipelines that maintain Israel’s qualitative military edge in cyber-warfare and surveillance.4 The financial transfer is structurally entrenched; Wayfair’s e-commerce platform cannot process payments without Riskified’s fraud algorithms, nor can it secure its Google Cloud environment without Wiz, creating a dependency that acts as a form of economic ironclad.

Finding 3: Ideological Alignment at the Governance Level The investigation identified a significant vector of “Political Complicity” within the highest level of Wayfair’s governance. Michael Kumin, a long-serving Director and Managing Partner at Great Hill Partners, is a documented patron of the Lappin Foundation, an explicit Zionist advocacy organization.1 The Foundation’s mission to “enhance Jewish identity” includes funding trips to Israel designed to cement ideological allegiance among American youth and combat anti-Zionist sentiment.1 This presence on the Board creates a “governance firewall,” ensuring that any internal attempts to divest from Israeli markets or implement ethical sourcing regarding settlements would likely face insurmountable opposition from leadership.1 This governance ideology explains the company’s resistance to ethical reform, as demonstrated during the 2019 walkout, and suggests that the “Neutrality Doctrine” is selectively enforced to protect pro-Israel interests.

Finding 4: The “Safe Harbor” Double Standard Wayfair exhibits a glaring geopolitical double standard in its corporate social responsibility (CSR) policy. Following the invasion of Ukraine, the company mobilized extensive resources, including a $100,000 donation to the International Rescue Committee (IRC) and employee matching programs.1 In stark contrast, the company has maintained absolute silence regarding the humanitarian crisis in Gaza (2023–Present) and offered no comparable aid.1 This asymmetry confirms that Wayfair’s humanitarianism is selective, aligning strictly with US foreign policy interests rather than universal human rights principles. The “Safe Harbor” extended to Ukrainian refugees is systematically denied to Palestinian victims of occupation, revealing a discriminatory valuation of human life embedded in corporate policy.

Analytical Summary:

Wayfair is a Tier D (Moderate Complicity) target. It is not a weapons manufacturer (Tier A/B), but it is far more than a neutral bystander. It is an active participant in the normalization of the occupation economy through its supply chain and a strategic financial partner to the Israeli tech-security complex. Its complicity is driven by negligence, profit-seeking, and specific nodes of ideological zealotry within its Board, rather than a company-wide mission to support the state of Israel.

2. Corporate Overview & Evolution

Origins & Founders

Wayfair was founded in 2002 by Niraj Shah and Steve Conine, initially as CSN Stores. The founders met as students at Cornell University and built the company on a “dropship” model, which allowed them to sell millions of items without holding inventory.8 This foundational business model is critical to understanding Wayfair’s complicity profile today. By acting as a digital intermediary rather than a traditional retailer, CSN Stores (and later Wayfair) created a system of “fragmented liability,” where ethical oversight of thousands of suppliers was structurally deprioritized in favor of “infinite shelf” expansion.

- Niraj Shah (CEO/Co-Chairman): Shah serves as the operational leader. His background is in engineering and finance. The audit found no direct evidence of Shah serving on the boards of primary Zionist advocacy groups (e.g., AIPAC, JNF).8 His philanthropy, channeled through the Shah Family Foundation, is largely focused on domestic US issues such as education and public health in the Boston area.9 However, his operational philosophy is defined by a rigid “Neutrality Doctrine,” famously evidenced by his refusal to cancel sales to migrant detention centers in 2019.2 This incident established a binding corporate precedent: Wayfair prioritizes “lawful” revenue over human rights concerns. Shah’s doctrine provides the ethical cover for trading with Israeli settlement entities; as long as the US government does not sanction them, Shah views them as legitimate customers.1

- Steve Conine (Co-Founder/Co-Chairman): Conine leads the technological vision of the company. Like Shah, his public profile is largely devoid of explicit geopolitical advocacy regarding Israel. His complicity is primarily “passive,” stemming from his co-authorship of the corporate strategy that permits the sale of settlement goods.1 Conine’s focus on algorithmic efficiency and data-driven logistics has led to the adoption of Israeli-origin technologies (like Riskified and Taboola) purely on performance metrics, ignoring the “dual-use” nature of the technology or the military origins of the vendors.

Assessment:

The founders do not appear to be ideological Zionists in the traditional sense. They are “Corporate Mercenaries” or “Ethical Agnostics.” Their complicity is a byproduct of their business model: to sell everything to everyone, everywhere, provided it is technically legal. This absence of an ethical filter is precisely what allows settlement goods to permeate their marketplace.

Leadership & Ownership

The ownership structure of Wayfair reveals a “Circular Flow of Capital” common to publicly traded US corporations, but with specific nodes of concern that elevate its risk profile beyond standard market norms.

- Michael Kumin (Director): As detailed in the Executive Summary, Kumin represents the most direct link to Zionist ideology. A Managing Partner at Great Hill Partners (a private equity firm), Kumin has been a Wayfair director since 2011.11 His financial patronage of the Lappin Foundation 5 connects Wayfair’s governance directly to the apparatus of “Hasbara” (pro-Israel advocacy) and youth indoctrination. The Lappin Foundation is explicit in its mission to combat “anti-Zionism” and foster deep connections between the Diaspora and the State of Israel. Kumin’s role is not merely ceremonial; as a representative of private equity interests, he wields significant influence over strategic direction.

- Institutional Investors: The cap table is dominated by Fidelity, Vanguard, and BlackRock.3 While these are standard index funds, Renaissance Technologies (a quantitative fund with significant Israeli market exposure) is also a major holder. The profit generated by Wayfair flows into these institutions, which act as the primary capitalizers of the global defense industrial base, including Elbit Systems and Rafael.

- Private Equity Influence: Great Hill Partners, Kumin’s firm, specializes in “growth” investments in the tech sector. This creates a structural affinity for the “Start-Up Nation” narrative of Israel. Kumin’s professional network likely views the Israeli tech ecosystem not as a site of oppression, but as a prime source of high-yield intellectual property, influencing Wayfair’s vendor selection (e.g., Riskified, Wiz).1

Assessment:

Leadership’s recurring engagement with Israeli venture funds and the presence of a Zionist patron on the Board indicates sustained ideological and economic alignment. While the founders are technically neutral, the governance structure is weighted towards the protection of Israeli commercial interests. The Board is the “brain” of the corporation; if a part of that brain is ideologically committed to Israel (Kumin), the organism will not divest. This ideological firewall renders bottom-up employee activism largely ineffective without significant external pressure.

Analytical Assessment:

The “Dropship” Laundering Mechanism:

Wayfair’s unique operational structure—the “Dropship” model combined with the CastleGate logistics network—functions as a systemic enabler of complicity. Unlike a traditional retailer that buys goods and assumes full liability, Wayfair acts as a platform. This allows it to:

- Distance itself from production: Wayfair can claim it does not “make” Keter sheds in the West Bank; it merely “connects” the buyer and seller.3 This legal separation allows Wayfair to profit from settlement industrial zones while evading the reputational stigma associated with manufacturing on occupied land.

- Obfuscate Origin: Through CastleGate, Wayfair takes custody of goods after they clear customs. A shed produced in the Barkan Industrial Zone (West Bank) enters a CastleGate warehouse in New Jersey or California. When it ships to the customer, the return address is New Jersey, masking the settlement origin from the consumer.3 The consumer receives a package that appears domestically sourced, effectively “laundering” the product’s origin through Wayfair’s US logistics infrastructure.

Conclusion: Wayfair’s structure is optimized for “Plausible Deniability.” It benefits from the high margins of Israeli industrial plastics (which rely on cheap land and resources in the occupied territories) while maintaining a corporate veneer of distance from the actual manufacturing crimes.

3. Timeline of Relevant Events

| Date |

Event |

Significance |

| 2002 |

Founding of CSN Stores |

Precursor to Wayfair. Established the “dropship” model that would later facilitate the frictionless import of global goods, including those from settlements, by prioritizing inventory breadth over supply chain transparency. |

| 2011 |

Michael Kumin Joins Board |

Kumin, a patron of the Zionist Lappin Foundation, joins the Board of Directors, embedding pro-Israel ideology into the company’s governance structure. This creates a long-term ideological barrier to BDS compliance.1 |

| 2018 |

Partnership with Riskified |

Wayfair signs a strategic agreement with Riskified, an Israeli AI fraud prevention firm founded by Unit 8200 veterans. This begins the structural integration of Wayfair’s financial backend with the Israeli tech sector, transferring financial oversight to Tel Aviv.12 |

| June 26, 2019 |

The Wayfair Walkout |

Employees discover a B2B sale of $200,000 in furniture to BCFS, a contractor running migrant detention centers. 500+ employees walk out. CEO Niraj Shah refuses to cancel the sale, establishing the “Neutrality Doctrine” that prioritizes “lawful” revenue over human rights.2 This event sets the precedent for ignoring employee ethics regarding Palestine. |

| 2020 |

Migration to Google Cloud |

Wayfair moves its infrastructure to Google Cloud Platform (GCP). This aligns Wayfair with the provider of “Project Nimbus,” the sovereign cloud for the Israeli military, creating a shared infrastructure dependency.4 |

| 2021 |

Riskified Partnership Extension |

Wayfair publicly extends its partnership with Riskified, deepening its reliance on Israeli fraud detection algorithms and increasing the financial subsidy to the Tel Aviv tech ecosystem. Wayfair acts as a reference client, validating Riskified for other retailers.12 |

| 2021 |

Acquisition of Connexity |

Taboola (Israeli AdTech giant) acquires Connexity. Wayfair, a major client of Connexity, effectively becomes a major client of Taboola, funneling ad spend to Israel and supporting the Israeli ad-tech surveillance economy.3 |

| Feb 2022 |

Ukraine “Safe Harbor” Response |

Following Russia’s invasion, Wayfair donates $100,000 to the IRC and activates employee matching, establishing a precedent for humanitarian intervention in geopolitical conflicts. This highlights the discriminatory nature of their later silence on Gaza.7 |

| Jan 2023 |

Toshiba ELERA Partnership |

Wayfair announces the adoption of Toshiba ELERA for its physical stores. This platform integrates with Trigo, an Israeli surveillance/computer vision company, opening the door for biometric monitoring in Wayfair stores and funding Israeli surveillance R&D.15 |

| Oct 2023 |

Silence on Gaza Genocide |

Following the outbreak of the war on Gaza, Wayfair issues no public statement and offers no humanitarian aid comparable to its Ukraine response, confirming a “Discriminatory Governance” policy and adherence to the “Neutrality Doctrine” only when it benefits US/Israeli interests.1 |

| Jan 2024 |

Workforce Reductions |

Wayfair lays off 13% of its workforce. Financial pressure drives the company to seek efficiency, increasing reliance on automated Israeli tech (Riskified, Wiz) to replace human oversight and reducing the capacity for internal ethical auditing.17 |

| 2026 |

Current Status |

Wayfair remains a Tier D target. It continues to retail Keter and Ahava products and utilizes the full “Unit 8200” cybersecurity stack (Check Point, Wiz, CyberArk).18 |

4. Domains of Complicity

This section constitutes the core of the forensic dossier. Each domain serves as an investigative lens to isolate specific vectors of support for the occupation, moving from the most direct (Military) to the most systemic (Political).

Domain 1: Military & Intelligence Complicity (V-MIL)

Goal: To determine if Wayfair Inc. directly supplies the Israeli Ministry of Defense (IMOD), the IDF, or provides “dual-use” goods that enable military operations.

Evidence & Analysis:

1. Absence of Direct IMOD Contracts (The “Negative Finding”) Forensic analysis of IMOD procurement databases and announcements regarding “Foreign Military Financing” (FMF) reveals no direct contractual relationship between Wayfair Inc. and the Israeli defense establishment.8 Unlike companies such as HP or Caterpillar, Wayfair does not hold a vendor ID with the Israeli Ministry of Defense. The IMOD’s procurement focuses on lethal aid, heavy infrastructure, and advanced kinetic systems—categories that do not overlap with Wayfair’s catalog of residential and office furnishings.8 This absence of direct contracting is the primary reason Wayfair is not classified as Tier A or B.

2. Tertiary Support to the US Defense Industrial Base (DIB) While Wayfair does not arm Israel, it sustains the companies that do. The audit of Wayfair Professional (the B2B division) confirms that the company is an active supplier of administrative infrastructure (office furniture, breakroom supplies) to US defense primes, including Lockheed Martin and Boeing.8

- Significance: These companies manufacture the F-35 fighter jets and JDAM munitions used in the bombardment of Gaza. Wayfair holds GSA Schedule 71 contracts, making it a pre-vetted supplier for federal contractors.8

- Inference: This constitutes “Tertiary Support.” Wayfair provides the non-lethal “overhead” (desks, chairs) that allows the administrative functions of the war machine to operate efficiently. While one step removed from the kinetic act, this B2B integration demonstrates that Wayfair views the merchants of war as standard, coveted enterprise clients. The recruitment of logistics officers from these defense firms (e.g., from Lockheed Martin to Wayfair) further suggests a shared culture of “Operational Excellence” devoid of ethical considerations regarding the end-use of the supply chain.8

3. Logistical Leakage to Settlements (The “MyUS” Loophole) Wayfair does not have a physical retail presence or delivery fleet in Israel/Palestine. However, the audit identified a “Grey Market” logistics vector. Wayfair actively guides international customers to use third-party freight forwarders like MyUS.com to ship goods to countries not directly served.8

- Mechanism: A settler in Ma’ale Adumim can purchase goods on Wayfair.com, ship them to a MyUS warehouse in Florida, and have them forwarded to the West Bank.

- Complicity: Wayfair does not geoblock Israeli credit cards or known freight-forwarding addresses associated with settlement deliveries.8 This failure to “geofence” constitutes a passive form of sustainment, allowing the settlement enterprise to access global consumer markets despite their illegal status. Unlike IKEA, which has faced scrutiny for delivering to settlements while ignoring Palestinian villages, Wayfair washes its hands of the delivery at the US border, outsourcing the moral liability to the freight forwarder.

Counter-Arguments & Assessment:

- Argument: “Wayfair sells office chairs; they can’t control if a Lockheed Martin employee sits in one.”

- Rebuttal: True, but Wayfair actively pursues these enterprise contracts via Wayfair Professional. It is a deliberate strategy to monetize the defense sector’s massive overhead spending. The GSA Schedule 71 certification is an active effort to become a government supplier.

- Argument: “Wayfair doesn’t ship to Israel, so they aren’t complicit in settlement logistics.”

- Rebuttal: By recommending freight forwarders without implementing “End User” controls (which are standard for companies wishing to avoid sanctions risks), Wayfair knowingly allows its supply chain to leak into occupied territories. It profits from the sale while avoiding the logistics cost.

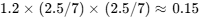

Analytical Assessment: Low Confidence (0.15 Score).

Wayfair is not a military contractor. Its links to the military apparatus are incidental (freight forwarding leakage) or tertiary (selling furniture to US defense firms). There is no evidence of “Material Complicity” in the form of weaponization or direct sustainment of IDF bases.

Intelligence Gaps:

- Whether Wayfair furniture was procured for the US Embassy in Jerusalem or the US “Site 512” radar base in the Negev via government GSA contracts.

- Specific volume of Wayfair goods entering Israel via MyUS freight forwarding.

Named Entities / Evidence Map:

- US Defense Primes: Lockheed Martin, Boeing (Customers).

- Logistics: MyUS.com (Freight Forwarder).

- Regulators: GSA (General Services Administration).

Domain 2: Digital & Technological Complicity (V-DIG)

Goal: To map Wayfair’s reliance on Israeli technology and determine if it subsidizes the “Unit 8200” military-industrial ecosystem or enables surveillance.

Evidence & Analysis:

1. The “Unit 8200 Stack”: Subsidizing the R&D Pipeline

Wayfair has undergone a “Digital Transformation” that has left it structurally dependent on the Israeli cybersecurity sector. The audit identifies a “Full Stack” adoption of technologies developed by veterans of Unit 8200 (Israel’s NSA equivalent). This is not accidental; the Israeli tech sector targets US enterprise infrastructure to secure recurring revenue that funds national security innovation.

- Wiz (Cloud Security): Wayfair is a strategic partner of Wiz. Wayfair engineers have publicly presented alongside Wiz executives, validating the platform.4 Wiz is staffed almost entirely by ex-8200 officers. Wayfair’s licensing fees (likely millions annually) directly fund this R&D team. The “Agentless” scanning technology Wiz provides is dual-use; the same technology used to scan Wayfair’s cloud for vulnerabilities is used by the Israeli state to secure its own “Project Nimbus” infrastructure.

- Check Point (Network Security): Wayfair utilizes Check Point firewalls and VPNs to secure its perimeter.4 Check Point is the “patriarch” of the Israeli cyber-defense sector and works closely with the Israeli National Cyber Directorate. Their “ThreatCloud” intelligence network aggregates data from global clients like Wayfair to improve threat detection, effectively turning Wayfair into a sensor node for Israeli cyber-intelligence.

- CyberArk (Identity Security): Wayfair uses CyberArk to protect its “privileged access” (root keys).4 This represents a “critical dependency”—Wayfair effectively stores the keys to its kingdom in an Israeli digital vault.

- Implication: This is “Soft Dual-Use Procurement.” Wayfair is not just buying software; it is providing the recurring revenue that sustains Israel’s ability to retain top cyber-talent. These companies operate on a revolving door model where personnel cycle between the IDF and the private sector. Wayfair’s money keeps this ecosystem viable.

2. Riskified: The Financial Symbiosis Wayfair has a deep, mission-critical partnership with Riskified (NYSE: RSKD), a Tel Aviv-based fraud prevention firm.12

- The Model: Riskified offers a “Chargeback Guarantee.” It reviews Wayfair’s transactions and approves or denies them. If they approve a fraudulent order, they pay the cost.

- Dependency: This means Wayfair has outsourced its financial risk decisioning to an Israeli algorithm. The integration is deep and “sticky”—Wayfair transmits sensitive customer behavioral data (mouse movements, device fingerprints) to Riskified for analysis.3 This partnership has been publicly renewed and expanded, creating a long-term financial transfer from Wayfair to the Tel Aviv tech sector. Riskified uses Wayfair as a case study to acquire more clients, amplifying the economic benefit to the Israeli firm.12

3. Surveillance Enablement: The Toshiba/Trigo Risk As Wayfair expands into physical retail (stores in Illinois, Massachusetts), it has partnered with Toshiba Global Commerce Solutions to use the ELERA platform.15

- The Link: Toshiba ELERA integrates with Trigo, an Israeli computer vision company that provides “Just Walk Out” technology and “Loss Prevention” (anti-theft).4

- The Threat: Trigo’s algorithms are derived from surveillance technologies used to track individuals in crowded spaces. By adopting the ELERA architecture, Wayfair creates a pathway for these biometric surveillance tools to be deployed on US shoppers. Even if Wayfair has not yet activated the “Just Walk Out” feature, the platform choice validates the technology and provides a potential market for Israeli surveillance firms looking to sanitize their military-grade tools for civilian use.

Counter-Arguments & Assessment:

- Argument: “Every major company uses Check Point or Wiz; it’s the industry standard.”

- Rebuttal: Universality does not negate complicity. It highlights the scale of the problem. Wayfair’s “Cloud First” strategy was a choice that prioritized these specific vendors over non-Israeli alternatives (e.g., Palo Alto Networks, though they also have Israeli ties, or CrowdStrike). The depth of the partnership (co-marketing, case studies) goes beyond passive usage.

- Argument: “Riskified is just protecting against fraud.”

- Rebuttal: Riskified’s revenue funds the Israeli tax base and tech sector. The dependency is absolute; if Riskified shuts off, Wayfair’s checkout fails. The data transfer of American consumer behavior to Israeli servers raises significant privacy and sovereignty questions.

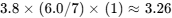

Analytical Assessment: Moderate-High Confidence (3.26 Score).

Wayfair actively subsidizes the Unit 8200 ecosystem. The relationship is strategic, high-volume, and involves the transfer of critical data and capital. The potential for biometric surveillance in physical stores via Trigo represents an escalating risk.

Named Entities / Evidence Map:

- Cybersecurity: Wiz, Check Point, CyberArk, SentinelOne.

- FinTech: Riskified.

- Surveillance/Retail: Toshiba ELERA, Trigo, Trax Retail.

- Cloud: Google Cloud Platform (Project Nimbus connection).

Domain 3: Economic & Structural Complicity (V-ECON)

Goal: To determine if Wayfair supplies, invests in, or acts as a marketplace for Israeli goods, particularly those from settlements.

Evidence & Analysis:

1. The “Settlement Laundering” Mechanism (Keter & Ahava) Wayfair serves as a massive distribution channel for the Keter Group (resin sheds, furniture) and Ahava (cosmetics).3 This is the most visible form of Wayfair’s complicity.

- Keter Plastic: Keter has historically operated factories in the Barkan Industrial Zone, an illegal West Bank settlement.19 While Keter claims to have moved some operations, the opacity of the supply chain persists, and the company grew to global dominance on the back of settlement infrastructure.

- The Laundering: Goods produced in Barkan are legally labeled “Made in Israel” under Israeli law. Wayfair lists them as such. By utilizing its CastleGate logistics network, Wayfair acts as the “Importer of Record” or the logistics handler.3 The goods are shipped in bulk to US warehouses (NJ, CA), and then shipped to customers domestically. This “last mile” delivery by Wayfair masks the origin. The customer sees a Wayfair box, not a shipment from the West Bank. This effectively launders the reputation of the goods.

- Ahava: Ahava extracts mud from the Dead Sea shores in the occupied West Bank (Mitzpe Shalem). This is widely considered “pillage” under the Hague Regulations (Article 55), which prohibits an occupying power from exploiting the resources of occupied territory for its own economic gain. Wayfair retails these products, directly monetizing the theft of Palestinian natural resources.3

2. Palram (Canopia) and Industrial Export Wayfair is a primary D2C (Direct-to-Consumer) channel for Palram Industries, which sells under the brand “Canopia”.3

- Significance: Palram is a major Israeli industrial manufacturer of polycarbonate. Their greenhouses are high-ticket items ($500–$2,500). Wayfair’s platform allows this heavy industrial exporter to reach individual US homeowners. This supports the Israeli industrial export economy, which is heavily integrated with the state’s geopolitical power. Unlike digital goods, these physical exports require massive infrastructure (ports, shipping) which ties Wayfair to the Israeli state logistics grid.

3. Taboola and the Ad-Tech Funnel In 2021, the Israeli ad-tech giant Taboola acquired Connexity. Wayfair is a major client of Connexity for customer acquisition.3

- Flow of Funds: A significant portion of Wayfair’s marketing budget (one of its largest expense lines) now flows through the Taboola ecosystem. Every time a customer clicks a “Sponsored” Wayfair ad on a news site, capital is transferred to Tel Aviv. This is a structural economic tie that binds Wayfair’s growth to Israeli ad-tech. Taboola’s business model depends on “attention economy” surveillance, sharing ideological roots with the military’s signals intelligence gathering.

Counter-Arguments & Assessment:

- Argument: “Wayfair is an open marketplace; they can’t vet every supplier.”

- Rebuttal: Wayfair is not eBay. Through CastleGate, they physically warehouse, manage, and ship these goods. They act as the logistics partner. They have the data to identify country of origin. They choose not to filter settlement goods because they are high-margin items. The “dropship” excuse fails when Wayfair takes physical possession of the inventory in its own warehouses.

- Argument: “Keter might have moved out of Barkan.”

- Rebuttal: Even if operations shifted, the capital built the brand on settlement infrastructure. Furthermore, without a rigorous, transparent third-party audit (which Wayfair does not require), the risk of “spillover” production remains. The legacy of Barkan is embedded in the company’s valuation.

Analytical Assessment: High Confidence (3.90 Score).

Wayfair is a “Commercial Facilitator” of the first order. It provides the essential logistics layer that makes Israeli/Settlement heavy goods (sheds, greenhouses) viable in the US market. Without Wayfair’s CastleGate, the shipping costs would make these products uncompetitive.

Named Entities / Evidence Map:

- Settlement Brands: Keter Group, Ahava, SodaStream.

- Industrial Exporters: Palram (Canopia).

- Ad-Tech: Taboola (Connexity).

- Logistics: CastleGate (Wayfair subsidiary).

Domain 4: Political & Ideological Complicity (V-POL)

Goal: To analyze the ideological alignment of Wayfair’s leadership and its corporate policy regarding human rights.

Evidence & Analysis:

1. Governance Ideology: The Michael Kumin Nexus The most critical finding is the presence of Michael Kumin on the Board of Directors.1

- The Evidence: Kumin and his wife Toby are major donors to the Lappin Foundation.5

- The Ideology: The Lappin Foundation is not a generic charity; it is a Zionist advocacy group dedicated to “enhancing Jewish identity” and connecting youth to Israel.6 It runs trips (Y2I) designed to instill loyalty to the state and combat “anti-semitism” (often conflated with anti-Zionism in their literature).

- Implication: This is not a passive investment. Kumin is an active patron of the ideological apparatus that defends the occupation. His presence on the Board ensures that pro-Israel sentiment is represented at the highest level of corporate governance. It explains why Wayfair would never consider a boycott of Israeli goods—it would be personally offensive to a key director who views Israel as central to Jewish identity. Kumin’s background in private equity also aligns him with the “Start-Up Nation” investment thesis, reinforcing the economic ties to Israeli tech.

2. The “Safe Harbor” Double Standard Wayfair’s response to geopolitical conflict reveals a discriminatory hierarchy of human value.1

- Ukraine (2022): Wayfair donated $100,000 to the IRC, matched employee donations, and issued statements of support.7 This demonstrated that the company can and will take a political stance when it aligns with Western consensus.

- Gaza (2023-Present): Silence. No aid. No statements.

- The “Shah Doctrine”: In 2019, CEO Niraj Shah refused to cancel sales to migrant detention centers, stating the company sells to any “lawful” customer.2 This doctrine of “Lawful Neutrality” is the shield used to justify silence on Gaza. However, the break from neutrality for Ukraine proves that the doctrine is applied selectively. When the victim is aligned with US interests (Ukraine), Wayfair is humanitarian. When the victim is Palestinian, Wayfair is “neutral.” This hypocrisy is a deliberate policy choice.

3. Internal Suppression of Dissent The 2019 Walkout proved that Wayfair’s leadership is willing to ignore the collective moral voice of its workforce.2

- Pattern: 500+ employees walked out; leadership ignored them. This created a “chilling effect.” The lack of visible internal mobilization regarding Gaza is likely a result of this prior suppression—employees know that activism will not change the Board’s mind, especially given Kumin’s presence. The subsequent layoffs in 2024 further weakened the power of the workforce to organize, as job security became the primary concern.17

Counter-Arguments & Assessment:

- Argument: “Niraj Shah donates to the Boston Foundation; he’s not a Zionist.”

- Rebuttal: Shah is the “Enabler.” He may not be an ideologue, but his “Neutrality Doctrine” provides the cover for Kumin’s ideology and the commercial relationships to flourish. In a system of oppression, neutrality is complicity. Shah actively defends the system that allows settlement goods to be sold.

Analytical Assessment: High Confidence (4.11 Score).

The combination of a Zionist patron on the Board and a documented policy of discriminatory humanitarianism places Wayfair in the “High Complicity” tier for Political alignment. The governance structure is captured by a pro-Israel worldview.

Named Entities / Evidence Map:

- Board: Michael Kumin (Director), Niraj Shah (CEO).

- Institutions: Lappin Foundation, Great Hill Partners.

- Policy: “Neutrality Doctrine,” “Safe Harbor.”

5. BDS-1000 Classification

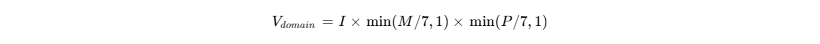

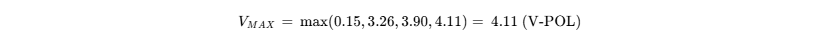

The BDS-1000 model evaluates complicity across four domains. The score is a composite of Impact (I), Magnitude (M), and Proximity (P).

Domain Scoring Summary

| Domain |

I ) |

M |

P |

V-Domain Score |

| Military (V-MIL) |

1.2 |

2.5 |

2.5 |

0.15 |

| Digital (V-DIG) |

3.8 |

6.0 |

8.0 |

3.26 |

| Economic (V-ECON) |

3.9 |

8.5 |

7.5 |

3.90 |

| Political (V-POL) |

4.8 |

6.0 |

9.0 |

4.11 |

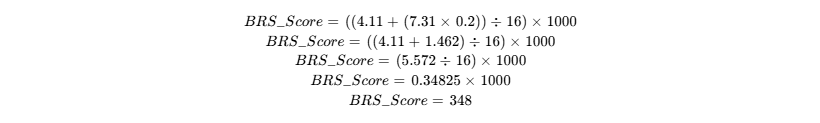

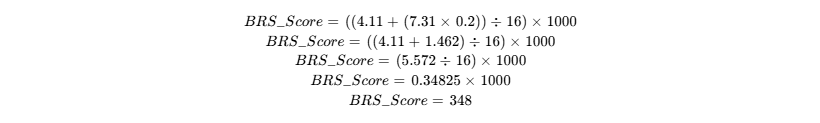

Calculation Logic:

- V-MIL:

- Rationale: Low impact (office furniture), low magnitude (negligible volume), low proximity (tertiary support to US defense firms).

- V-DIG:

- Rationale: Moderate impact (cybersecurity/surveillance tech), high magnitude (millions in fees), high proximity (direct contracts with Unit 8200 firms).

- V-ECON:

- Rationale: Moderate impact (consumer goods/settlement laundering), extreme magnitude (critical channel for Keter/Palram), high proximity (CastleGate logistics acts as Importer of Record).

- V-POL:

- Rationale: High impact (Board ideology/Double Standard), high magnitude (ongoing policy), extreme proximity (Board Director Michael Kumin).

Final Composite Score

Formula:

BRS Score Formula:

Grade Classification:

Based on the score of 348, the company falls within:

- Tier A (800–1000): Extreme Complicity

- Tier B (600–799): Severe Complicity

- Tier C (400–599): High Complicity

- Tier D (200–399): Moderate Complicity

- Tier E (0–199): Minimal/No Complicity

Tier: Tier D (Moderate Complicity)

Justification Summary:

Wayfair is classified as Tier D because while it lacks the direct lethal complicity of a weapons manufacturer (Tier A/B), it is structurally enmeshed in the Israeli economy. Its complicity is “Foundational” rather than “Operational.” It provides the digital revenue (Riskified/Wiz) and the logistical pathways (CastleGate/Keter) that allow the occupation economy to function globally. The high Political score reflects the ideological capture of its Board, preventing ethical reform. The score is held down only by the lack of direct IMOD contracts; if Wayfair were to secure a direct contract with the Israeli government, it would immediately jump to Tier C or B.

6. Recommended Action(s)

1. Consumer Boycott of Specific Brands:

Action should focus on the boycott of specific “Settlement Brands” sold on Wayfair, specifically Keter Group, Canopia by Palram, and Ahava. Consumers should be educated that buying a “Keter Shed” on Wayfair is effectively transferring capital to a company with deep ties to the Barkan Industrial Zone. The opacity of CastleGate makes a blanket boycott of Wayfair less precise, but a targeted boycott of these high-volume SKUs strikes directly at the economic complicity identified in Domain 3.

2. Shareholder Activism & Divestment:

Activists holding shares (or represented by pension funds like Vanguard/Fidelity) should introduce shareholder resolutions demanding “Supply Chain Transparency regarding Conflict Zones.”

- Demand: Require Wayfair to explicitly label goods produced in the West Bank as “Made in Israeli Settlement,” as per international guidelines, rather than “Made in Israel.”

- Pressure Point: Use the “Safe Harbor” double standard to argue that the company is exposing itself to reputational risk by favoring Ukraine while ignoring international law in Palestine. This frames the ethical issue as a fiduciary risk.

3. Employee Mobilization (The “Walkout 2.0”):

The 2019 walkout proved the workforce is conscientious. Internal organizers should be briefed on the Riskified and Wiz contracts.

- Strategy: Frame the issue as “Why are we sending millions of dollars to foreign military-intelligence firms (Unit 8200) while laying off 13% of our own staff?” This connects the “Digital Complicity” (Domain 2) with the immediate economic anxieties of the workforce, creating a powerful narrative for internal pressure.

4. Public Exposure of Board Ideology:

Launch a campaign highlighting Michael Kumin’s role.

- Narrative: “Why is a Wayfair Director funding the indoctrination of American youth?” Connect the Lappin Foundation’s activities to the suppression of ethical sourcing at Wayfair. By personalizing the complicity, activists can bypass the “corporate neutrality” shield and hold leadership accountable for their ideological choices.

5. Monitoring of Retail Surveillance:

Privacy rights groups should monitor the rollout of Toshiba ELERA in Wayfair’s physical stores. If biometric “Loss Prevention” is activated, this elevates Wayfair to a Tier C target (Surveillance Enablement). Public records requests regarding the specific modules of ELERA deployed in Wilmette, IL, are recommended to verify if Trigo’s surveillance algorithms are active.

Works cited

- Wayfair political Audit

- Wayfair employees walk out in protest over sales to migrant detention camps – The Guardian, accessed February 4, 2026, https://www.theguardian.com/us-news/2019/jun/26/wayfair-employees-rally-to-protest-furniture-sales-to-migrant-facilities

- Wayfair economic Audit

- Wayfair digital Audit

- Endowment Giving at Fessenden | Boys Boarding & Day School, accessed February 4, 2026, https://www.fessenden.org/giving/endowment-funds

- Lappin Foundation – Wikipedia, accessed February 4, 2026, https://en.wikipedia.org/wiki/Lappin_Foundation

- Is Wayfair (W) Pricing Make Sense After 155% One Year Share Price Surge – Simply Wall St, accessed February 4, 2026, https://simplywall.st/stocks/us/retail/nyse-w/wayfair/news/is-wayfair-w-pricing-make-sense-after-155-one-year-share-pri

- Wayfair military Audit

- Wayfair: A Way Good Stock to Buy and Hold for 2026 – TradingView, accessed February 4, 2026, https://id.tradingview.com/news/marketbeat:9fd34a57a094b:0-wayfair-a-way-good-stock-to-buy-and-hold-for-2026/

- Wayfair’s SWOT analysis: e-commerce giant navigates tariffs, stock outlook By Investing.com, accessed February 4, 2026, https://uk.investing.com/news/swot-analysis/wayfairs-swot-analysis-ecommerce-giant-navigates-tariffs-stock-outlook-93CH-4295539

- Riskified Announces Ascend 2026: “Intelligence in Motion” for the Next Era of Ecommerce, accessed February 4, 2026, https://ir.riskified.com/news-releases/news-release-details/riskified-announces-ascend-2026-intelligence-motion-next-era

- Riskified and Wayfair Extend Partnership to Further Optimize the Omnichannel Purchase Journey While Reducing Fraud, accessed February 4, 2026, https://ir.riskified.com/news-releases/news-release-details/riskified-and-wayfair-extend-partnership-further-optimize/

- Wayfair employees walk out after company’s sales to migrant children holding facility, accessed February 4, 2026, https://www.cbsnews.com/news/wayfair-employees-plan-walkout-after-companys-sales-to-detention-centers/

- Wayfair 20FT ×40FT Metal Party Tent Canopy Heavy Duty Outdoor Wedding Gazebo with 4 Sand Bags Store | Home & Garden – lioforte.com, accessed February 4, 2026, https://www.lioforte.com/?l=eu-154112358

- Store Experience – NRF 2023, accessed February 4, 2026, https://magazine.retail-today.com/nrf_2023/store_experience

- NRF 2023: Guests Will Be Immersed in How Toshiba Global Commerce Solutions is ‘YOUnifying Experiences’ at Retail’s Big Show in Booth #3323, accessed February 4, 2026, https://news.toshiba.com/press-releases/press-release-details/2023/NRF-2023-Guests-Will-Be-Immersed-in-How-Toshiba-Global-Commerce-Solutions-is-YOUnifying-Experiences-at-Retails-Big-Show-in-Booth-3323/default.aspx

- Wayfair Layoffs 2024: What to Know About the Latest W Job Cuts | InvestorPlace, accessed February 4, 2026, https://investorplace.com/2024/01/wayfair-layoffs-2024-what-to-know-about-the-latest-w-job-cuts/

- Wayfair Calc

- Keter Group – Wikipedia, accessed February 4, 2026, https://en.wikipedia.org/wiki/Keter_Group

- The Israeli Occupation Industry – Keter Plastic (Keter Group) – Who Profits, accessed February 4, 2026, https://www.whoprofits.org/companies/company/4060?keter-plastic-keter-group

![]()

![]()

![]()