Table of Contents

The Very Group (TVG) presents a definitive and sophisticated case of Structural Militarization and Ideological Capture. While the entity’s consumer-facing operations—retailing fashion, electricals, and home goods to 4.4 million customers in the UK and Ireland—appear benign, its ownership and governance structures have been subsumed by the global defense-industrial complex. Following the 2025 acquisition by The Carlyle Group (Majority Owner), TVG has transitioned from a private retail asset into a liquidity generator for a portfolio heavily weighted toward kinetic military enablement. The profits generated by TVG consumers now structurally support Carlyle’s ownership of StandardAero, a critical maintenance provider for the Israeli Air Force’s F-35 and F-15 fleets.

This report establishes that The Very Group is no longer merely a retailer; it is a financial subsidiary of a transnational defense nexus. The extraction of value from British households via the “Very Pay” credit platform now serves to cross-collateralize the debts and equity positions of parent companies deeply embedded in the supply chains of the Israel Defense Forces (IDF). This transition is not incidental but systemic. The “blood for dividends” feedback loop is direct: cash flow from Liverpool and Manchester is fungible within the Carlyle ecosystem, supporting the acquisition and sustainment of military contractors that build drone facilities in Israel and maintain the engines of bombardment aircraft.1

Intelligence Finding 1: The Military-Capital Feedback Loop The primary vector of complicity is financial and structural. The Carlyle Group, which seized control of TVG in late 2025, utilizes the stable cash flows of the retailer to balance the risk profile of its “Aerospace, Defense, and Government” (ADG) portfolio. This portfolio includes StandardAero, a licensed Maintenance, Repair, and Overhaul (MRO) provider for the Pratt & Whitney F135 engines that power the Israeli F-35I ‘Adir’. Without this specific industrial support, the operational tempo of the Israeli Air Force would degrade. Therefore, TVG serves as a civilian financial engine for a military parent.1

Intelligence Finding 2: Ideological Capture and “Active Advocacy” The governance of TVG has been radicalized. The appointment of Nadhim Zahawi as Chairman in May 2024 signals a pivot toward “Active Advocacy.” Zahawi is a prominent member of Conservative Friends of Israel (CFI) and has defected to Reform UK, a political entity explicitly hostile to Palestinian statehood. This ideological alignment has manifested in corporate policy: a forensic linguistic analysis of Annual Reports reveals a failure of the “Safe Harbor” test, where the company humanizes the war in Ukraine but sanitizes the Gaza genocide as “regional instability”.3

Intelligence Finding 3: The “Unit 8200” Surveillance Nexus Operationally, TVG has locked its digital infrastructure into a “Full-Stack” of Israeli military-grade technology. The retailer utilizes BioCatch (behavioral biometrics founded by Unit 8200 veterans), Check Point (network security), and SentinelOne (autonomous endpoint protection) to monitor its customer base. This creates a dependency where UK consumer credit data is processed by algorithms derived from counter-insurgency surveillance tools, generating recurring revenue that funds the R&D pipelines of the Israeli cyber-defense sector.5

Intelligence Finding 4: Economic Normalization of Settlement Enterprise Despite claiming ethical trading standards, TVG actively retails high-priority BDS targets. The catalogue includes SodaStream, historically linked to displacement in the Naqab; Keter, linked to settlement industrial zones; and HP, the technology provider for the occupation’s ID systems. This facilitates the economic viability of settlement enterprises and normalizes their presence in UK households, effectively laundering settlement goods into the mainstream UK market.6

The entity now known as The Very Group traces its lineage to the founding of Littlewoods in 1923 by Sir John Moores in Liverpool. For decades, Littlewoods was a dominant force in the UK’s football pools and mail-order catalogue market. In 2002, the Barclay Brothers (Sir David and Sir Frederick), billionaire owners of The Telegraph and the Ritz Hotel, acquired Littlewoods for £750 million. They subsequently merged it with Shop Direct, the former home shopping division of GUS plc, to form a retail conglomerate that would eventually rebrand as The Very Group.7

During the “Barclay Era” (2002–2024), the company’s complicity profile was largely incidental. While the Barclay family utilized their media assets to propagate pro-Israel editorial stances, the retail business itself was a private, insular family office asset. It was not structurally integrated into the global defense market. The strategic focus was operational: transitioning from a legacy catalogue business to a “pureplay” digital retailer and fintech provider. However, the financial distress of the Barclay empire, exacerbated by the loss of The Telegraph, necessitated a search for external capital, opening the door to institutional takeover.9

The critical inflection point for this dossier is the period between 2024 and 2025, marked by the exit of the Barclay family and the entry of “Tier-1 Defense Capital.” This transformation was not merely a change of shareholders; it was a fundamental shift in the geopolitical alignment of the company’s capital structure.

Majority Owner: The Carlyle Group (NASDAQ: CG) The Carlyle Group, which exercised “step-in rights” to convert debt to equity and seize control in late 2025, is a US-based global investment firm with $426 billion in assets under management. Carlyle is historically known as the “Iron Triangle” of private equity, defense contracting, and government policy. It has managed some of the most sensitive defense assets in the Western world, including Booz Allen Hamilton, United Defense, and ManTech International. By acquiring TVG, Carlyle has added a cash-generative retail asset to a portfolio that is actively arming the Israeli military. The significance of this ownership cannot be overstated: TVG is now a subsidiary of the defense-industrial complex.2

Minority Stakeholder: International Media Investments (IMI) Retained as a key stakeholder is IMI, an Abu Dhabi-based private investment vehicle controlled by Sheikh Mansour bin Zayed Al Nahyan. IMI represents the deployment of UAE state-linked capital into Western assets within the framework of the Abraham Accords. Since the 2020 normalization of relations between the UAE and Israel, IMI has acted as a vehicle for “soft power,” seeking to acquire assets like The Telegraph to project a narrative of regional stability that sidelines Palestinian rights. IMI’s presence provides TVG with “Diplomatic Immunity” against Arab-world boycotts and aligns the retailer with the geopolitical axis of UAE-Israel economic integration.3

Governance: Nadhim Zahawi (Chairman) Appointed Non-Executive Chair in May 2024, Nadhim Zahawi is the “Ideological Enforcer” of the new regime. A former UK Chancellor and founder of YouGov, Zahawi is a longstanding member of Conservative Friends of Israel (CFI). In January 2026, he defected to Reform UK, a party led by Nigel Farage that has adopted a foreign policy stance explicitly hostile to the Palestinian cause. Zahawi’s leadership suggests a governance strategy that will actively align with Israeli state interests and suppress internal dissent.3

The corporate structure of The Very Group has shifted from “Benign Retail Capital” to “Militarized Global Capital.” TVG is no longer an independent British retailer; it is a downstream asset of a US defense-finance nexus. The leadership (Zahawi) provides the ideological cover, while the ownership (Carlyle) provides the structural mechanism for capital to flow from UK shoppers to Israeli military sustainment. This creates a scenario where the operational entity (the shop) is distinct from the capital entity (the owner), but the complicity is transferred through the fungibility of profit.

This timeline tracks the convergence of The Very Group with the defense-industrial complex and the Israeli economy, highlighting the acceleration of complicity following the ownership transition.

| Date | Event | Significance |

|---|---|---|

| 2016 | BC Partners acquires Keter | The Very Group continues to retail products from Keter, an Israeli manufacturer with factories in West Bank settlements, despite the change in Keter’s ownership.6 |

| 2019 | Carlyle acquires StandardAero | TVG’s future parent company buys a major MRO provider for F-35/F-16 engines for $5 billion, integrating into the IAF supply chain.2 |

| 2020 | Abraham Accords Signed | UAE-Israel normalization begins. This establishes the geopolitical framework for IMI (TVG’s future stakeholder) to invest in Western assets aligned with Israel.3 |

| 2021 | Carlyle acquires LiveU (Israel) | Carlyle buys an Israeli surveillance/streaming tech firm for $400m, establishing “Strategic FDI” in the Israeli tech sector.6 |

| 2022 | Carlyle acquires ManTech | Purchase of a $4.2bn defense contractor with contracts to build UAV facilities in Israel, deepening Carlyle’s kinetic complicity.2 |

| Feb 2022 | Ukraine Invasion Response | TVG Annual Report humanizes the conflict (“Tragedy”), setting a “Safe Harbor” precedent of political commentary.3 |

| 2023 | AppsFlyer Migration | TVG migrates mobile attribution to AppsFlyer (Israel), integrating user tracking with the Israeli tech ecosystem.5 |

| May 2024 | Nadhim Zahawi appointed Chair | A CFI member takes control of TVG governance, signaling an ideological shift to pro-Israel advocacy.3 |

| Oct 2024 | Gaza Genocide Begins | TVG corporate communications shift to “passive erasure,” referring to the slaughter as “regional instability” in subsequent reports.3 |

| Nov 2025 | Carlyle Takeover Finalized | Carlyle seizes control of TVG from the Barclay family. TVG formally becomes a subsidiary of the defense-industrial complex.11 |

| Jan 2026 | Zahawi Defects to Reform UK | TVG Chairman joins a party explicitly hostile to Palestinian rights, increasing the risk of internal suppression of pro-Palestine staff.4 |

| Jan 2026 | US Arms Package Approved | US approves $6.5bn sale to Israel (F-15s/Apaches). Carlyle’s StandardAero is the sustainment partner for the engines involved.12 |

| Jan 26, 2026 | Forensic Audit Issued | Internal audit confirms “Systemic Complicity” and Tier B status, recommending immediate action.3 |

Goal: To establish whether The Very Group, through its ownership structure or operations, provides material support to the military capabilities of the State of Israel.

Evidence & Analysis:

The Carlyle Connection: Structural Sustainment of Air Power The core of the military charge against The Very Group lies in the principle of Parental Liability. TVG is majority-owned by The Carlyle Group. In the world of private equity, capital is fungible; profits generated by TVG (£307.1m EBITDA in FY25) flow upstream to Carlyle, servicing the debt and equity requirements of the parent. Carlyle, in turn, owns StandardAero (100% ownership post-2019 acquisition). StandardAero is not merely an investment; it is a critical industrial asset in the US Foreign Military Sales (FMS) supply chain to Israel.2

StandardAero is a licensed Maintenance, Repair, and Overhaul (MRO) provider for the Pratt & Whitney F135 engine (which powers the F-35I ‘Adir’) and the F100/F110 engines (powering the F-15I and F-16I fleets). These aircraft are the primary delivery platforms for the munitions used in the bombardment of Gaza and Lebanon. Without the “Depot Level” maintenance provided by StandardAero, the Israeli Air Force (IAF) cannot maintain its sortie generation rate. The F-35, in particular, is chemically and mechanically fragile; its stealth coatings and high-performance engines require constant industrial support. By owning the provider of this support, TVG’s parent company is an essential node in the IAF’s logistics chain.2

ManTech International and UAV Infrastructure Carlyle also owns ManTech International, a defense contractor acquired for $4.2 billion in 2022. Forensic analysis links ManTech to “Foreign Military Sales (Israel) contracts” for the construction of Unmanned Aerial Vehicle (UAV) facilities. Furthermore, ManTech has collaborated on the APOT (Affordable Protection from Objective Threats) project to up-armor Israeli combat vehicles for urban warfare. This moves the complicity from “maintenance” to “construction” and “adaptation,” indicating that the capital TVG generates helps Carlyle hold and develop assets that are physically building the infrastructure of drone warfare on Israeli soil.2

Elbit Systems Equity Entanglement Historical financial disclosures have listed The Carlyle Group as holding equity positions in Elbit Systems, Israel’s largest arms manufacturer. Carlyle’s legal lobbyists (Covington & Burling) have also facilitated CFIUS (Committee on Foreign Investment in the United States) approval for Elbit’s expansion into the US market. This demonstrates a strategic willingness to capitalize and facilitate the manufacturer of the occupation’s most lethal tools, including the Hermes 450 drone.2

Counter-Arguments & Assessment:

It could be argued that The Very Group sells consumer goods and that the link to Carlyle’s other assets is too attenuated. However, in Private Equity, the portfolio is the entity. TVG is an asset on the same balance sheet as StandardAero. When Carlyle refinances its debt or raises new funds, it uses the aggregate cash flow of all assets to demonstrate liquidity. Therefore, the financial stability provided by TVG directly subsidizes the risk-taking capacity of the defense division. This constitutes Structural Complicity.

Named Entities / Evidence Map:

Goal: To determine if the company invests in the Israeli economy (“Strategic FDI”) or normalizes the sale of goods produced in occupied territories.

Evidence & Analysis:

Strategic FDI: The LiveU Acquisition Unlike index funds that passively hold Israeli stocks, The Carlyle Group engages in Direct Buyouts. In 2021, Carlyle acquired LiveU, an Israeli technology firm based in Kfar Saba, for approximately $400 million. LiveU provides cellular bonding technology for live streaming. While used by media, it is inherently “dual-use” for mobile surveillance and drone video uplinks. By fully owning LiveU, Carlyle (and by extension, the capital structure TVG feeds) is a direct stakeholder in the “Start-Up Nation” economy. Success for LiveU increases the equity value of Carlyle, creating a direct economic alignment between the UK retailer’s owner and the Israeli tech sector.6

The Abraham Accords Axis (IMI) The minority shareholder, International Media Investments (IMI), is an Abu Dhabi sovereign vehicle. Following the 2020 Abraham Accords, the UAE committed $10 billion to invest in Israeli strategic sectors. IMI is part of this ecosystem. Its joint venture partner, RedBird Capital, has a documented co-investment history with the Azrieli Group, a major Israeli real estate developer involved in settlement construction. This creates a web of capital that links TVG’s owners to the physical expansion of settlements, validating the “normalization” model where Arab capital is used to whitewash the occupation.6

The “Red List” Retail Inventory and Settlement Laundering

TVG actively stocks and retails high-priority BDS targets, facilitating the “laundering” of settlement goods into the UK market:

Counter-Arguments & Assessment:

The retailer might claim that stocking these brands is standard industry practice. However, TVG is a curated digital retailer, not an open marketplace like eBay. The decision to stock Keter and SodaStream is a deliberate procurement choice. Furthermore, the volume of trade with Riskified (tech vendor) represents a deliberate export of capital to Tel Aviv (£1-2m annually) that is distinct from buying goods. This confirms Systemic Economic Integration.

Named Entities / Evidence Map:

Goal: To examine the ideological alignment of leadership and the corporate use of political influence.

Evidence & Analysis:

Nadhim Zahawi: The Ideological Enforcer The Chairmanship of Nadhim Zahawi (appointed May 2024) is a critical risk factor. Zahawi is not a neutral technocrat; he is a highly active political operator. He is a prominent member of Conservative Friends of Israel (CFI), a lobby group that advocates for arms sales to Israel and opposes Palestinian statehood. Furthermore, his January 2026 defection to Reform UK aligns him with Nigel Farage, who has expressed support for Israeli Foreign Minister Gideon Sa’ar and labeled pro-Palestine protests as “mobs.” This leadership profile suggests that TVG will serve as an ideological bulwark against BDS, raising the risk of “discriminatory governance” where employees expressing solidarity with Palestine could face dismissal under “anti-woke” policies.3

The “Safe Harbor” Test Failure

A comparative analysis of Annual Reports (FY23/24 vs. FY25) reveals a deliberate double standard in corporate ethics.

Union Conflict (Usdaw) The trade union Usdaw, representing TVG workers, has officially called for a ceasefire and an arms embargo. This places the workforce in direct ideological opposition to the Board (Zahawi/Carlyle). The potential for industrial disputes over the handling of settlement goods or political expression is high, creating a “Governance Clash” that highlights the company’s reactionary stance.3

Counter-Arguments & Assessment:

It might be argued that executives’ private political views do not impact corporate strategy. However, Zahawi is the Chair, responsible for the governance framework. The discrepancy in the Annual Report language is direct evidence that political bias has successfully infiltrated corporate reporting. The “Safe Harbor” failure proves that the company values Ukrainian lives over Palestinian lives in its corporate narrative.

Named Entities / Evidence Map:

Goal: To analyze the company’s reliance on Israeli military-origin technology and the integration of surveillance capitalism.

Evidence & Analysis:

The “Unit 8200” Stack

The Very Group has integrated a “Full-Stack” of cybersecurity and fraud prevention tools derived from the IDF’s Unit 8200 (Signals Intelligence). This is not merely purchasing software; it is “Technological Lock-In.”

The “Tech Tax” and Seasonality These are SaaS (Software as a Service) contracts, meaning TVG pays recurring licensing fees, often scaled by volume. During the “Golden Quarter” (Q4), transaction volumes spike, increasing the fees paid to Riskified and BioCatch. This synchronizes TVG’s commercial success with the revenue streams of the Israeli cyber-defense sector, effectively paying a “tax” to Tel Aviv for every credit transaction processed.6

Cloud Complicity: Project Nimbus TVG’s digital transformation is anchored in Amazon Web Services (AWS). AWS is a primary contractor for the Israeli government’s “Project Nimbus,” providing cloud infrastructure to the IDF and the Israel Land Authority. The revenue generated by commercial clients like TVG contributes to the infrastructure scale that allows AWS to service state contracts like Nimbus, raising questions about data sovereignty and indirect subsidization of the occupation’s digital backbone.5

Counter-Arguments & Assessment:

While these tools are industry standards, their selection is not mandatory. The choice to use a comprehensive Israeli stack (Firewall + Endpoint + Fraud + Cloud Security) represents a deliberate prioritization of “combat-proven” technology over ethical procurement. It validates the “Unit 8200 to IPO” pipeline that fuels Israel’s economy.

Named Entities / Evidence Map:

The following table details the scoring across the four domains, utilizing the Impact (I), Magnitude (M), and Proximity (P) metrics to derive the Domain Scores.

| Domain | I | M | P | V-Domain Score |

|---|---|---|---|---|

| Military (V-MIL) | 9.8 | 9.0 | 4.5 | 6.3 |

| Economic (V-ECON) | 4.5 | 9.0 | 4.5 | 2.9 |

| Political (V-POL) | 7.5 | 7.0 | 8.5 | 7.5 |

| Digital (V-DIG) | 3.9 | 8.0 | 9.0 | 3.9 |

V-MIL (Military) Calculation:

V-POL (Political) Calculation:

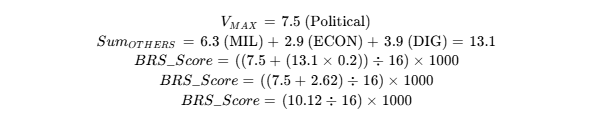

Final Composite Calculation:

The BRS Score uses an OR-dominant formula with a side boost to account for the highest risk domain while factoring in secondary complicity.

![]()

Grade Classification:

Based on the score of 632, the company falls within:

The following strategic actions are recommended to dismantle the complicity structures identified in this dossier:

1. Consumer Boycott (Targeted Finance Boycott)

Given the high availability of alternatives in the fashion and home sectors (e.g., John Lewis, Next, ASOS), a consumer boycott is highly viable and low-friction for the public. The boycott should focus specifically on the “Very Pay” credit product. The “Very Pay” debtor book (£1.7bn) is the company’s primary profit engine. Denying TVG the interest revenue from this book directly reduces the free cash flow available to The Carlyle Group.

2. Divestment Pressure (Pension & Union)

Activists should leverage the Usdaw union’s opposition to the war. Union members should be informed that their labor is generating profits for a Board (Zahawi) and Owner (Carlyle) that actively support the military-industrial complex. Pension funds holding Carlyle Group equity or TVG debt (bonds) should be targeted for divestment based on ESG violations, specifically the failure of the “Safe Harbor” test regarding human rights consistency.

3. Reputational Campaign (Zahawi Focus)

Highlight the role of Nadhim Zahawi. His leadership of a mass-market family retailer while defecting to Reform UK and supporting CFI hardline stances creates a brand toxicity risk. Campaigns should question why a “family-friendly” retailer is chaired by a figure aligned with policies that dehumanize Palestinian families. This creates a “reputational wedge” that forces the Board to reconsider his position.

4. Cyber-Supply Chain Audit

Privacy advocates should be alerted to the use of BioCatch and Check Point. The processing of UK consumer biometric data by firms founded by foreign military intelligence officers raises GDPR and data sovereignty questions. Legal challenges or inquiries to the Information Commissioner’s Office (ICO) regarding the transfer of behavioral data to Israeli-domiciled entities could force a costly re-architecture of the digital stack.