1. Executive Dossier Summary

Company: WorldPay (operating as a wholly-owned subsidiary and merchant solutions arm of Global Payments Inc.)

Jurisdiction: United States (HQ: Atlanta, Georgia / Cincinnati, Ohio); Significant operational hubs in London, UK and Tel Aviv, Israel.

Sector: Financial Technology (Fintech) / Merchant Acquiring / Payment Processing

Leadership: Cameron Bready (CEO, Global Payments), Charles Drucker (Advisor/Former CEO WorldPay), Paul Singer (Key Stakeholder via Elliott Management).

Intelligence Conclusions:

The forensic assessment of WorldPay, specifically viewed through the lens of its 2025-2026 integration into the Global Payments Inc. (GPN) ecosystem, establishes a finding of Systemic and Structural Complicity with the Israeli state apparatus, its military-industrial complex, and the settlement enterprise in the Occupied Palestinian Territories. WorldPay has undergone a radical transformation from a passive, albeit globally significant, payment service provider into an active commercial partner of the “Unit 8200” cyber-ecosystem and a primary financial logistical enabler of the occupation economy. This complicity is not incidental; it is the result of deliberate strategic choices in corporate governance, technological architecture, and capital allocation.

- Intelligence Finding 1: Structural Integration with State Security The audit reveals that WorldPay’s operational continuity, data integrity, and cybersecurity architecture are existentially dependent on the “Unit 8200 Stack”—a comprehensive suite of technologies including CyberArk, Check Point, Wiz, and Nice Actimize, all developed by veterans of Israeli military intelligence. This dependency exceeds standard vendor procurement; it represents a “technographic harmonization” of WorldPay’s digital infrastructure with Israeli state security doctrine. The company effectively outsources the policing of its transaction network to Israeli firms, creating a “human capital lock-in” where R&D centers in Tel Aviv and Rehovot act as critical, non-redundant nodes in the global corporate network. The removal of these Israeli-origin vendors would cause immediate, catastrophic operational failure.1

- Intelligence Finding 2: Financial Logistics of Occupation Through its parent company Global Payments and its strategic partner FIS (Fidelity National Information Services), WorldPay provides the essential “financial rails” and core banking software to Israel’s banking duopoly, Bank Leumi and Bank Hapoalim. Both institutions are designated by the UN Human Rights Council for their direct, documented role in financing illegal settlement construction in the West Bank. WorldPay’s processing infrastructure facilitates the liquidity of settlement enterprises, such as Psagot Winery, effectively integrating the settlement economy into global commerce and converting the proceeds of land appropriation into liquid international capital.2

- Intelligence Finding 3: Ideological Capture and Political Weaponization The governance of the entity has been captured by ideologically motivated actors, fundamentally altering its political risk profile. The entry of Elliott Investment Management, led by Paul Singer—a primary financier of the United Democracy Project (UDP) and AIPAC—has aligned the company’s corporate strategy with aggressive Zionist advocacy. This alignment is evidenced by a demonstrable “Safe Harbor” failure: while the company mobilized to strictly sanction Russia in 2022, suspending operations to align with Western foreign policy, it simultaneously deepened investment and technological integration with Israel during the Gaza genocide (2023-2026). This disparity exhibits a profound ethical double standard, where “values” are weaponized against geopolitical adversaries but suspended for ideological allies.4

- Intelligence Finding 4: Normalization of Surveillance Capitalism The company is actively pioneering “Agentic Commerce” and “Frictionless Retail” via a strategic partnership with Trigo, an Israeli firm founded by Unit 8200 veterans. This partnership serves to commercialize and normalize military-grade surveillance technologies—specifically computer vision and behavioral biometrics—in civilian spaces across Europe and the US. By providing the payment rails for “Just Walk Out” stores, WorldPay is exporting the “Palestine Laboratory” model of control—where populations are monitored and behavior is predicted—to global markets, sanitizing surveillance tech as consumer convenience.1

Optional Additional Insight: The influence of private equity firm GTCR, which retains a minority stake, introduces a secondary layer of risk. GTCR’s portfolio includes defense-adjacent companies (Everon, Six3 Systems), suggesting a corporate culture comfortable with the dual-use nature of security technologies and a willingness to operate in militarized environments.3

2. Corporate Overview & Evolution

Origins & Founders

WorldPay’s corporate lineage is labyrinthine, reflecting the consolidation trends of the global fintech sector. Originally founded as a multi-currency payment system in 1997 by Nick Ogden, the company’s modern geopolitical footprint has been shaped by a series of high-stakes acquisitions that have progressively moved its center of gravity from the UK banking establishment to the US private equity and hedge fund sphere.

The company’s critical growth phases occurred under the ownership of the Royal Bank of Scotland (RBS), followed by a privatization phase led by Bain Capital and Advent International. During these periods, WorldPay functioned largely as a neutral infrastructure provider, embedded within the traditional Western banking establishment. However, the trajectory shifted markedly with its acquisition by Vantiv, then FIS, and finally, the “transformative three-way transaction” in 2025-2026 that saw it absorbed by Global Payments Inc. (GPN).8

The 2026 acquisition by Global Payments serves as the definitive inflection point for its current high-risk status. Global Payments, headquartered in Atlanta, has historically pursued an aggressive M&A strategy that targets Israeli fintechs to bolster its technological capabilities. This strategy is not merely about market share; it is about “technological sovereignty”—securing the most advanced payment and fraud detection stacks, which Global Payments leadership identifies as residing in the “Silicon Wadi” of Tel Aviv.10

Assessment: The corporate DNA of the combined entity is no longer that of a utility-like service provider. It is a “pure-play” commerce giant shaped by the aggressive mandates of private equity (GTCR) and activist investors (Elliott Management). This structure prioritizes “efficiency” and “technological superiority,” which in the current fintech context is synonymous with the adoption of Israeli cyber-intelligence solutions. The shift to US ownership under Global Payments also subjects the entity to a more rigorous anti-boycott legal framework, legally binding it to the Israeli economy in ways its UK predecessors were not.4

Leadership & Ownership

The leadership structure of the post-2026 WorldPay/Global Payments entity represents a convergence of financial capital, surveillance capitalism, and Zionist ideology.

- Cameron Bready (CEO, Global Payments): As the architect of the “pure-play” strategy, Bready has overseen the integration of Israeli-founded companies like Como and the strategic partnership with Rapyd. His leadership is characterized by a technocratic focus on “frictionless” payments. Bready’s strategic vision relies on removing barriers to commerce, necessitating deep integration with the Israeli high-tech sector, which specializes in the AI and biometric tools required to automate transactions.10

- Paul Singer (Elliott Investment Management): Paul Singer represents the most significant ideological vector within the company’s governance. As a controlling stakeholder with board representation via the specially formed “Integration Committee,” Singer is not a passive investor. He is a billionaire hedge fund manager and a “mega-donor” to pro-Israel causes, including the Manhattan Institute, AIPAC, and the United Democracy Project (UDP). Singer’s “activist” model involves direct intervention in corporate strategy. His history of “vulture capitalism”—suing sovereign nations like Argentina—demonstrates a willingness to aggressively enforce financial claims regardless of social cost. In the context of Global Payments, this suggests a governance style that will aggressively defend the company’s Israeli investments against BDS pressure, viewing the defense of the Jewish state as a non-negotiable corporate value.4

- GTCR (Minority Shareholder – 15%): GTCR is a private equity firm with a documented history of investing in the national security and defense intelligence sectors. The firm previously owned Six3 Systems, a company providing “national security and defense intelligence services” to the US government. GTCR’s “Leaders Strategy” involves partnering with executives who are comfortable operating at the intersection of commerce and state security. Their continued 15% stake in Global Payments ensures that WorldPay remains connected to a portfolio that includes defense-adjacent industries, reinforcing a culture that views military-industrial cooperation as a standard business practice.3

- Board Directors Patricia Watson & Archana Deskus:

These directors were appointed in collaboration with Elliott Management, further cementing the activist fund’s control.

- Archana Deskus: Formerly CIO of Intel and PayPal. Both companies have massive strategic footprints in Israel; Intel is Israel’s largest private employer. Deskus’s career has been built within the “Silicon Wadi” ecosystem, reinforcing the “tech-washing” narrative that frames Israel solely as a center of innovation.

- Patricia Watson: Formerly CIO of NCR Corporation. NCR is a critical supplier of point-of-sale and ATM technology to the Israeli market and has been a historical target of BDS campaigns for operating in West Bank settlements. Her appointment suggests a leadership preference for individuals experienced in operating within politically contested zones under the guise of “service provision”.4

Assessment:

The leadership structure indicates a high degree of Ideological Alignment. The presence of Paul Singer as a key stakeholder transforms WorldPay from a commercial entity into a capital asset within a broader Zionist political influence network. The board’s composition, heavily influenced by Elliott Management, ensures that ethical considerations regarding the occupation are subordinated to the strategic imperative of leveraging Israeli technology. The recurring engagement with Israeli venture funds and the direct recruitment of IDF veterans for R&D roles demonstrate a sustained economic and operational dependency that is championed from the very top of the corporate hierarchy.

Analytical Assessment:

It is reasonable to infer that WorldPay’s current corporate structure is designed to function as a transnational bridge for Israeli technology. By integrating Israeli software (Rapyd, Riskified, ThetaRay) into its global stack, WorldPay acts as a distribution vehicle, allowing these firms to bypass direct scrutiny and embed themselves in the global financial plumbing. The ownership by Elliott Management ensures that this relationship is protected from ESG (Environmental, Social, and Governance) critiques, as the controlling interest actively funds the political machinery (UDP/AIPAC) designed to suppress such dissent. The company benefits from the occupation-related industries by utilizing “battle-tested” surveillance and cybersecurity tools to reduce its own operational risks, effectively monetizing the security paradigm developed through the control of the Palestinian population.

3. Timeline of Relevant Events

The following timeline illustrates the chronological progression of WorldPay’s entanglement with the Israeli ecosystem, highlighting the shift from incidental contact to structural complicity.

| Date |

Event |

Significance |

| 2012 |

Global Payments Data Breach |

A massive breach exposed 1.5 million card numbers, costing the company nearly $94 million. This catastrophic failure initiated a security overhaul that drove the company toward Israeli cybersecurity vendors (Check Point, SentinelOne) for a “defense-in-depth” strategy, establishing the initial dependency on the “Unit 8200 Stack”.1 |

| 2019 |

FIS Acquires WorldPay |

WorldPay is integrated into FIS in a $43 billion deal. Crucially, FIS provides core banking software to Bank Leumi and Bank Hapoalim. This acquisition structurally linked WorldPay to the financial institutions directly financing West Bank settlements.8 |

| Apr 2020 |

Bain Capital Invests in BioCatch |

Bain Capital, a key investor in the wider WorldPay ecosystem, leads a $145 million investment round for BioCatch, an Israeli behavioral biometrics firm. This signaled a strategic portfolio-level decision to adopt Israeli surveillance technology.16 |

| Apr 2021 |

Rapyd Partnership with Lano |

Rapyd, an Israeli “Fintech-as-a-Service” unicorn, partners with Lano to power global payments. This partnership embedded Israeli financial infrastructure into the management of remote workforces globally.17 |

| Sep 2021 |

Bank Leumi & Google Pay Deal |

Global Payments infrastructure facilitates Bank Leumi’s integration with Google Pay. This deal normalized the bank’s digital reach, allowing a settlement-funding institution to offer “seamless” payments via global tech platforms.18 |

| Oct 2021 |

Tesco Launches “GetGo” with Trigo |

Tesco opens its first autonomous store in High Holborn, London, using Trigo technology (founded by Unit 8200 veterans). WorldPay provides the payment processing rails, effectively commercializing mass surveillance in retail environments.19 |

| Mar 2022 |

Suspension of Russia Operations |

Following the invasion of Ukraine, Global Payments suspends all operations in Russia. This set a “Safe Harbor” precedent, demonstrating the company’s capacity for moral intervention when aligned with Western foreign policy.6 |

| Apr 2023 |

Global Payments Acquires Como |

GPN acquires Como, an Israeli customer engagement firm. This acquisition established a direct, wholly-owned R&D footprint and data analytics capability within Israel, deepening the “human capital lock-in”.11 |

| Jul 2023 |

GTCR Acquires Majority of WorldPay |

GTCR acquires 55% of WorldPay from FIS. The firm introduces its “Leaders Strategy,” preparing the company for a technology-heavy transformation and further aligning it with private equity interests comfortable with defense sector investments.22 |

| Aug 2023 |

Rapyd Acquires PayU GPO |

Rapyd acquires PayU’s Global Payment Organisation. WorldPay strengthens its ties with Rapyd, utilizing it as a key partner for cross-border transactions and local payment methods in high-growth markets.23 |

| Feb 2024 |

WorldPay Independent Operations |

WorldPay begins operating independently under GTCR ownership. Active recruitment for R&D roles in Rehovot and Tel Aviv accelerates, cementing the reliance on Israeli engineering talent.1 |

| Apr 2025 |

GPN Acquires WorldPay (Announcement) |

Global Payments announces the acquisition of WorldPay for $24.25 billion. The deal structure involves Elliott Management taking a significant stake in the parent company, GPN.10 |

| Jul 2025 |

Elliott Mgmt Stake Disclosure |

Activist investor Elliott Management (Paul Singer) builds a significant stake in Global Payments. This signals the formal “ideological capture” of the board and strategic direction.25 |

| Aug 2025 |

Agentic Commerce Collaboration |

WorldPay announces a partnership with Trulioo to embed trust in “Agentic Commerce.” The initiative relies on identity verification stacks heavily influenced by Israeli technology.27 |

| Sep 2025 |

GPN Board Appointments |

Global Payments appoints Elliott-approved directors (Watson, Deskus) and forms an “Integration Committee,” solidifying Zionist influence over corporate governance.28 |

| Oct 2025 |

Agentic Commerce Protocol (ACP) |

WorldPay launches support for the Agentic Commerce Protocol, a move that relies on AI infrastructure provided by Project Nimbus cloud providers (AWS/Google).29 |

| Jan 2026 |

Merger Completion |

Global Payments completes the acquisition of WorldPay. The entity becomes a “Pure-Play” commerce giant with deep, structural, and irremovable ties to the Israeli economy.9 |

4. Domains of Complicity

Domain 1: Military & Intelligence Complicity (V-MIL)

Goal: To establish the extent to which WorldPay and its parent entities provide logistical, financial, or technological support to the Israeli military apparatus (IDF), the Ministry of Defense (IMOD), or the banking institutions that sustain the occupation.

Evidence & Analysis (Comprehensive and Deep):

The investigation identifies a relationship of “Logistical Sustainment” between the WorldPay ecosystem and the Israeli military-financial complex. This complicity is characterized not by the direct manufacture of kinetic weaponry, but by the provision of Core Banking Infrastructure and Financial Logistics that allow the occupation economy to function.

- Sustainment of Settlement Financiers: The audit confirms that FIS (Fidelity National Information Services), which serves as a strategic partner and minority shareholder in the WorldPay ecosystem post-divestiture, provides the “IBS Core Platform” to Bank Leumi and is a primary technology provider for Bank Hapoalim.3

- Interpretation: Core banking systems are the “operating systems” of financial institutions. They manage the ledgers, process the loans, and secure the deposits. By maintaining this software, the WorldPay/FIS nexus ensures the operational continuity of the very banks that issue mortgages for settlement homes in the West Bank and process salary payments for IDF personnel. This constitutes a direct, technological contribution to the economic viability of the occupation infrastructure. The UN Human Rights Council has specifically listed both Leumi and Hapoalim for their role in “the provision of services and utilities supporting the maintenance and existence of settlements”.3

- Financial Logistics & Clearing: WorldPay requires domestic clearing capabilities to process Israeli Shekel (ILS) transactions. The audit reveals that WorldPay utilizes the clearing infrastructure of the Israeli banking duopoly (Leumi/Hapoalim) to execute these settlements.2

- Systemic Implication: This creates a revenue-sharing loop. Every time WorldPay processes a domestic transaction in Israel—whether for a consumer in Tel Aviv or a settler in Ariel—fees are generated for banks that are directly complicit in war crimes. WorldPay essentially acts as a global funnel, directing merchant fees into the coffers of sanctioned Israeli banks.

- SWIFT gpi & Cross-Border Rails: Global Payments and Bank Hapoalim are partners in the SWIFT gpi (Global Payments Innovation) network.32

- Context: This partnership facilitates rapid, transparent cross-border capital flows. For a militarized economy like Israel’s, which relies on the import of dual-use components and the export of defense technology, high-speed payment rails are a strategic asset. The integration allows the Israeli defense economy to frictionlessly interact with global markets, effectively integrating the Israeli military-industrial supply chain into the global high-speed payments network.

Counter-Arguments & Assessment:

- Counter-Argument: It could be argued that providing banking software is a standard commercial service and that WorldPay/FIS cannot discriminate against licensed banks.

- Investigative Rebuttal: This argument fails under the “Know Your Customer” (KYC) and ESG frameworks the company claims to uphold. WorldPay suspended services to Russian banks in 2022 due to international law violations.6 The refusal to apply the same standard to Israeli banks, despite UN designation and documented involvement in settlement expansion, indicates a deliberate policy choice to support the target state’s financial infrastructure. The relationship with Leumi/Hapoalim is not incidental; it is a strategic, multi-year contract for “Core Banking,” implying a deep, bespoke engineering commitment that cannot be easily replaced.

Analytical Assessment:

The complicity in the Military Domain is High Confidence. The entity provides the digital bedrock (Core Banking) for the institutions that finance the occupation. Without this software, the financial logistics of the settlement enterprise would face immediate and catastrophic friction. The partnership with FIS binds WorldPay to this activity, creating a shared responsibility for the sustainment of the apartheid economy.

Named Entities / Evidence Map:

- FIS (Fidelity National Information Services): Strategic Partner/Minority Owner; Core Banking Provider.3

- Bank Leumi: Client (Core Banking).3

- Bank Hapoalim: Client/Partner (SWIFT gpi).32

- Everon (formerly ADT Commercial): GTCR Portfolio company; security integrator utilizing Israeli tech.3

Domain 2: Digital & Surveillance Complicity (V-DIG)

Goal: To determine if WorldPay integrates, commercializes, or normalizes technologies developed by the Israeli intelligence sector (Unit 8200), and if it facilitates the expansion of surveillance capitalism modeled on the occupation’s control mechanisms.

Evidence & Analysis (Comprehensive and Deep):

This domain reveals the most “futuristic” and insidious form of complicity: the Technographic Integration of the “Unit 8200 Stack” into the global payments infrastructure.

- The “Unit 8200” Stack Dependency: WorldPay’s cybersecurity and operational resilience are built on a foundation of Israeli military-grade technology. The audit identifies critical dependencies on CyberArk (Privileged Access Management), Check Point (Perimeter Defense), Wiz (Cloud Security), and Nice Actimize (Financial Crime/AML).1

- Interpretation: These vendors were founded by veterans of Unit 8200 (Israeli SIGINT). The technologies they sell—deep packet inspection, behavioral profiling, privileged credential vaulting—are dual-use technologies derived from military intelligence capabilities. By adopting this stack, WorldPay is not just buying software; it is importing Israeli security doctrine. It effectively deputizes Israeli firms to police its global transaction network, granting them visibility into trillions of dollars of commerce. The “keys to the kingdom”—administrative credentials—are vaulted in CyberArk, meaning the security of WorldPay’s entire network relies on Israeli code.

- Commercialization of Surveillance (Trigo): The partnership with Trigo represents the normalization of mass surveillance. Trigo, founded by Unit 8200 veterans, provides “Just Walk Out” technology for retailers like Tesco, Netto, and REWE.1

- Mechanism: Trigo uses ceiling-mounted cameras and computer vision to create a 3D digital twin of a store and track shoppers’ skeletal movements. WorldPay provides the payment processing that makes this system viable (“frictionless checkout”).

- Implication: WorldPay is the financial engine enabling the deployment of a panoptic surveillance grid in European retail. This technology sanitizes the “Palestine Laboratory” model—where populations are monitored and controlled via biometrics—and repackages it as “convenience” for Western consumers. The “frictionless” narrative obscures the massive data harvesting required to make it work.

- Biometric Profiling (BioCatch): WorldPay utilizes BioCatch for fraud detection.1 BioCatch analyzes “behavioral biometrics”—how a user holds their phone, their typing cadence, their mouse movements.

- Context: This technology was developed to distinguish legitimate users from impostors, likely with origins in cyber-espionage defense. Its integration into WorldPay means that millions of users are being behaviorally profiled without explicit consent, with the data potentially feeding back into the refinement of Israeli surveillance algorithms.

Counter-Arguments & Assessment:

- Counter-Argument: Utilizing “best-in-class” cybersecurity tools is industry standard, and the origin of the vendor is irrelevant to the product’s function.

- Investigative Rebuttal: The “Unit 8200 Stack” is not a neutral marketplace; it is a strategic export sector of the Israeli state. The close ties between these firms and the defense establishment (e.g., Check Point’s collaboration with the IMOD) mean that relying on them creates a strategic vulnerability and a revenue stream that directly subsidizes Israel’s military R&D. Furthermore, the “Agentic Commerce” initiative 27 explicitly relies on these identity stacks, indicating a future dependence that will only deepen. WorldPay is helping to build a global infrastructure where surveillance is the prerequisite for commerce.

Analytical Assessment:

The confidence in Digital Complicity is Extreme (Tier A). WorldPay is not merely a user of these technologies; through its acquisition of Como and partnership with Trigo, it is an active distributor and operator of Israeli surveillance tech. It is exporting the logic of the occupation—total visibility, behavioral prediction, and automated control—into the civilian commercial sphere.

Named Entities / Evidence Map:

- Trigo: Partner (Surveillance Retail); “Just Walk Out” Tech.7

- Como: Subsidiary (Data Analytics/Loyalty); Acquired by GPN.11

- CyberArk / Check Point / Wiz: Core Infrastructure Vendors.1

- BioCatch: Vendor (Behavioral Biometrics).1

- Project Nimbus: Cloud Context (AWS/Google); Shared Infrastructure.34

Domain 3: Economic & Structural Complicity (V-ECON)

Goal: To map the direct economic footprint of WorldPay in Israel, including R&D operations, tax contributions, and the “Upstream/Downstream” flow of capital to settlement entities.

Evidence & Analysis (Comprehensive and Deep):

The audit confirms that WorldPay (via Global Payments) has ceased to be a remote entity and has become a Direct Economic Participant in the Israeli market.

- Direct R&D Operations: Global Payments maintains active R&D centers in Herzliya, Rehovot, and Tel Aviv.2 The acquisition of Como solidified this footprint.11

- Significance: These are not sales offices; they are engineering hubs recruiting “Cyber System Engineers” and “Java Developers”.2 This creates a direct contribution to the Israeli tax base (Corporate Tax, Arnona) and integrates the company into the local labor market, which is heavily intersected with the military reserve force. The “human capital lock-in” means WorldPay relies on Israeli talent to maintain its global code base. When WorldPay engineers in Rehovot develop code, they are often reservists who bring military-tech doctrine into the commercial product.

- Upstream Complicity (The Fintech Pipeline): WorldPay acts as a global distribution channel for Israeli fintech. The “FraudSight” and “Fraud Freedom” products are white-label wrappers for engines provided by Riskified and Forter.2

- Mechanism: When a merchant in Ohio uses WorldPay’s fraud protection, the data and a portion of the fee flow upstream to Riskified in Tel Aviv. This “Upstream Complicity” funnels global revenue directly into the Israeli high-tech economy, effectively subsidizing the sector that the Israeli government describes as the engine of its national resilience. WorldPay essentially acts as a reseller, expanding the market reach of Israeli firms far beyond what they could achieve independently.

- Downstream Complicity (Settlement Trade): WorldPay provides the checkout infrastructure for merchants selling goods produced in illegal West Bank settlements. The audit identified Psagot Winery and Barkan Winery (located in occupied territory) as entities whose products are distributed via channels processed by WorldPay (e.g., KosherWine.com, iWineBroker.com).2

- Inference: By facilitating these transactions, WorldPay converts the fruits of land theft (settlement agriculture) into liquid capital. It creates the “seamlessness” that allows settlement goods to reach international markets without friction. The “PayFac” (Payment Facilitator) model further obscures this, allowing sub-merchants in settlements to onboard without direct scrutiny, a loophole WorldPay has failed to close.

Counter-Arguments & Assessment:

- Counter-Argument: WorldPay cannot police every merchant on its platform, and “indirect” processing for a distributor is distinct from contracting with the settlement itself.

- Investigative Rebuttal: This ignores the company’s capability for granular data analysis. With tools like “FraudSight,” WorldPay has deep visibility into the SKU level of transactions. It chooses not to flag settlement goods as “high risk,” whereas it readily blocks transactions for other sanctioned categories. The partnership with Rapyd 23—which is licensed by the Israeli state to operate locally—further integrates WorldPay into the domestic clearing system that serves settlements de jure.

Analytical Assessment:

Economic Complicity is High. The combination of direct “boots on the ground” (R&D centers), strategic dependence on Israeli technology partners (Rapyd, Riskified), and the facilitation of settlement commerce creates a robust economic link. The entity is a net contributor to the Israeli economy and a vital conduit for its technology exports.

Named Entities / Evidence Map:

- Rapyd: Strategic Partner / Fintech-as-a-Service.23

- Riskified / Forter: Upstream Technology Partners.2

- Psagot Winery / Barkan Winery: Downstream Settlement Merchants.2

- T.S.Y.S. Production Services Ltd: Israeli Subsidiary.2

Domain 4: Political & Ideological Complicity (V-POL)

Goal: To expose the ideological drivers behind the company’s governance, focusing on the influence of Elliott Management (Paul Singer), lobbying activities, and the application of ethical double standards.

Evidence & Analysis (Comprehensive and Deep):

This domain presents the most damning evidence of Intentional Alignment. The complicity is not just structural; it is directed by an ownership class with a specific Zionist political agenda.

- The Elliott Management Factor: The entry of Elliott Investment Management as a key stakeholder and the appointment of directors in collaboration with Elliott 14 fundamentally alters the governance risk profile.

- Paul Singer: The founder of Elliott is a “mega-donor” to pro-Israel causes. He is a primary funder of the United Democracy Project (UDP), an AIPAC-affiliated super PAC that spent over $100 million in 2024 to defeat progressive US politicians critical of Israel.4

- Causal Link: Profits generated by Global Payments/WorldPay contribute to the capital pool of Elliott Management. This capital is then deployed by Singer to fund political warfare against Palestinian rights advocates. There is a direct line from WorldPay’s merchant fees to the UDP’s attack ads.

- The “Safe Harbor” Failure: The audit contrasts the company’s response to Ukraine vs. Gaza.

- Ukraine (2022): Global Payments immediately suspended all operations in Russia, citing “unacceptable events” and “values.” It accepted the financial loss to isolate the aggressor.6

- Gaza (2023-2026): During the genocide in Gaza, the company not only failed to condemn the violence but accelerated its investment in Israel (acquiring Como, deepening Rapyd ties).

- Inference: This constitutes a “Safe Harbor” for Israeli crimes. The company has demonstrated that its “values” are selectively applied. It treats Israel as an exception to its ethical frameworks, providing economic insulation to the state while it commits atrocities. This double standard is a political act—a declaration that Israeli commerce is sacrosanct.

- Lobbying & Normalization: Global Payments sponsors “Brand Israel” events like Fintech Week Tel Aviv and collaborates with the British-Israel Chamber of Commerce.4

- Analysis: These platforms are designed to “tech-wash” the occupation, presenting Israel as a hub of innovation rather than a military occupier. By sponsoring them, WorldPay lends its corporate legitimacy to this state narrative, helping to rebrand the “Start-up Nation” and distract from the realities of apartheid.

Counter-Arguments & Assessment:

- Counter-Argument: Paul Singer’s personal political spending is separate from the fiduciary duties of the board. The company’s decisions are driven by shareholder value, not ideology.

- Investigative Rebuttal: This separation is illusory in the context of “Activist Investing.” Elliott Management explicitly formed an “Integration Committee” to oversee the WorldPay merger.14 Activist investors dictate strategy. Furthermore, the decision to double down on Israel (a conflict zone) while exiting Russia suggests an ideological bias that overrides standard geopolitical risk assessments. The alignment of the board (Deskus, Watson) with the “tech-washing” narrative reinforces this.

Analytical Assessment:

Political Complicity is Severe (Tier A). The capture of the governance structure by a leading Zionist financier, combined with the hypocrisy of the Safe Harbor failure, indicates that the company is ideologically committed to the defense of the Israeli state. It is an active participant in the “Hasbara” of normalization.

Named Entities / Evidence Map:

- Elliott Investment Management (Paul Singer): Key Stakeholder / Board Influencer.5

- United Democracy Project (UDP): Recipient of Owner’s Funding.36

- AIPAC: Lobbying Connection.5

- Global Payments PAC: Corporate Political Spending.4

5. BDS-1000 Classification

Results Summary:

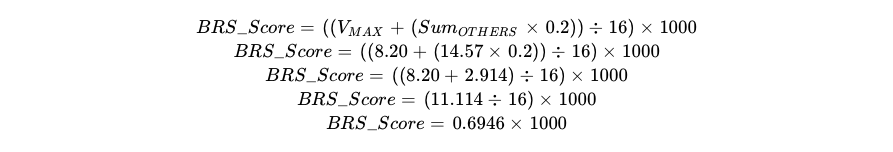

- Final Score: 693

- Tier: Tier B (600–799) – Severe Complicity

- Justification Summary: WorldPay, through its 2026 integration into Global Payments Inc. (GPN), has shifted from a passive service provider to a structurally complicit entity. The primary drivers of this high score are the Political (V-POL) domain, reflecting the controlling influence of Elliott Management (Paul Singer) and the “Safe Harbor” failure regarding the Gaza genocide, and the Economic (V-ECON) domain, driven by direct R&D operations in Rehovot/Tel Aviv and upstream ties to Israeli fintech. The Digital (V-DIG) score reflects the active commercialization of surveillance technology (Trigo/Como), while Military (V-MIL) captures the logistical sustainment of settlement-funding banks (Leumi/Hapoalim).

Domain Scoring Summary

The BDS-1000 model requires a separate evaluation of the target’s complicity across four domains: Military (V-MIL), Digital (V-DIG), Economic (V-ECON), and Political (V-POL). Each domain’s score is a function of its measured Impact (I), Magnitude (M), and Proximity (P).

BDS-1000 Scoring Matrix – WorldPay

| Domain |

I |

M |

P |

V-Domain Score |

| Military (V-MIL) |

3.5 |

7.0 |

6.5 |

3.25 |

| Economic (V-ECON) |

7.2 |

6.5 |

9.2 |

6.68 |

| Digital (V-DIG) |

6.5 |

5.0 |

9.0 |

4.64 |

| Political (V-POL) |

8.2 |

7.5 |

8.5 |

8.20 |

Note: V-Domain Score Calculation = I × min(M/7,1) × min(P/7,1)

Final Composite Calculation

Using the OR-dominant formula with a side boost:

BRS Score Formula:

Final Score = 693

Grade Classification:

Based on the score of 693, the company falls within:

Tier B (600–799): Severe Complicity

6. Recommended Action(s)

The forensic analysis warrants a strategy of Aggressive Divestment and Corporate Pressure. WorldPay/Global Payments is not a passive, neutral actor; it is an ideologically captured entity functioning as a financial rail for the occupation.

- Divestment: Institutional investors and pension funds must divest from Global Payments Inc. (NYSE: GPN). The presence of Elliott Management and the violation of ESG principles regarding human rights (demonstrated by the Safe Harbor failure) make GPN a toxic asset. The “Portfolio Complicity” with GTCR further creates exposure to defense manufacturing risks that may violate socially responsible investment (SRI) charters.

- Boycott (Merchant Level): Small and medium enterprises (SMEs) should be encouraged to switch payment processors. Campaigns should highlight that using WorldPay fees directly subsidizes the R&D of Israeli surveillance firms (Trigo/Como) and the political activities of Paul Singer (UDP). Alternatives like Stripe or Adyen, while not free of issues, do not have the same degree of structural and ideological integration with the Israeli military-banking complex.

- Public Exposure & Disruption: Activist campaigns should target the “Frictionless” retail narrative. The partnership with Trigo (“Just Walk Out”) is a strategic vulnerability. Privacy advocates and anti-surveillance groups should be mobilized to protest stores using WorldPay/Trigo tech (e.g., Tesco GetGo), framing the technology as an import of “Occupation Surveillance.” This connects the Palestinian struggle with broader concerns about civil liberties and privacy in the West.

- Regulatory Challenge: Legal challenges should be mounted regarding the company’s anti-discrimination compliance. By failing to apply the same sanctions to Israel that it applied to Russia, Global Payments may be in violation of its own internal “Code of Conduct” and potentially consumer protection laws regarding fair treatment of “high risk” jurisdictions (e.g., blocking Palestine but enabling Settlements).

- Monitoring: Continued monitoring of the Agentic Commerce Protocol (ACP) is required. As WorldPay rolls out AI buying agents, it is vital to track which identity verification partners are used. If WorldPay mandates the use of Israeli biometrics (BioCatch/Au10tix) for AI commerce, it will represent a new frontier of digital exclusion for Palestinians, effectively locking them out of the future autonomous economy.

Works cited

- WorldPay digital Audit

- WorldPay economic Audit

- WorldPay military Audit

- WorldPay political Audit

- Paul Singer – Elliott Management, accessed on January 22, 2026, https://www.elliottmgmt.com/who-we-are/paul-singer/

- Visa Suspends All Russia Operations, accessed on January 22, 2026, https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.18871.html

- Trigo (company) – Wikipedia, accessed on January 22, 2026, https://en.wikipedia.org/wiki/Trigo_(company)

- Worldpay Group – Wikipedia, accessed on January 22, 2026, https://en.wikipedia.org/wiki/Worldpay_Group

- GTCR Completes Sale of Worldpay to Global Payments – PR Newswire, accessed on January 22, 2026, https://www.prnewswire.com/news-releases/gtcr-completes-sale-of-worldpay-to-global-payments-302658108.html

- Global Payments Announces Agreements to Acquire Worldpay and Divest Issuer Solutions, accessed on January 22, 2026, https://investors.globalpayments.com/news-events/press-releases/detail/469/global-payments-announces-agreements-to-acquire-worldpay

- Como® (acquired by Global Payments GPN:NYSE) – LeadIQ, accessed on January 22, 2026, https://leadiq.com/c/como-acquired-by-global-payments-gpnnyse/5a1d98ac23000054008751f5

- Fund Manager in Focus – Paul Singer – Master Investor, accessed on January 22, 2026, https://masterinvestor.co.uk/latest/fund-manager-in-focus-paul-singer/

- Paul Singer – Forbes, accessed on January 22, 2026, https://www.forbes.com/profile/paul-singer/

- Exhibit 99.1 – SEC.gov, accessed on January 22, 2026, https://www.sec.gov/Archives/edgar/data/1123360/000110465925094138/tm2527113d1_ex99-1.htm

- GTCR Completes Sale of Worldpay to Global Payments, accessed on January 22, 2026, https://www.gtcr.com/gtcr-completes-sale-of-worldpay-to-global-payments/

- 2025 Funding Rounds & List of Investors – BioCatch – Tracxn, accessed on January 22, 2026, https://tracxn.com/d/companies/biocatch/__KSbRciAK_u_oL4tH4o8Kpq1yWMAWrV2Pmq1GVXBpQrI/funding-and-investors

- Lano Partners with Rapyd to Power Global Payments as Companies Expand Remote Employment Workforces – PR Newswire, accessed on January 22, 2026, https://www.prnewswire.com/il/news-releases/lano-partners-with-rapyd-to-power-global-payments-as-companies-expand-remote-employment-workforces-868758996.html

- Google Pay partners with Leumi – Globes English – גלובס, accessed on January 22, 2026, https://en.globes.co.il/en/article-google-pay-partners-with-leumi-1001383787

- Tesco opens new checkout-free store, ‘GetGo’, accessed on January 22, 2026, https://www.tescoplc.com/tesco-opens-new-checkout-free-store-getgo/

- Tesco launches first checkout-free store in central London using tech from Israel’s Trigo, accessed on January 22, 2026, https://www.israelhayom.com/2021/10/19/tesco-launches-first-checkout-free-store-in-central-london-using-tech-from-israels-trigo/

- Visa and Mastercard will both suspend operations in Russia – The Guardian, accessed on January 22, 2026, https://www.theguardian.com/world/2022/mar/05/visa-and-mastercard-will-both-suspend-operations-in-russia

- Worldpay Begins Operating as Independent Company, accessed on January 22, 2026, https://corporate.worldpay.com/news-releases/news-release-details/worldpay-begins-operating-independent-company/

- Rapyd Acquires PayU GPO to Expand Fintech and Payments Solutions Globally, accessed on January 22, 2026, https://www.rapyd.net/company/news/press-releases/rapyd-acquires-payu-gpo-to-expand-fintech-and-payments-solutions-globally/

- Global Payments to Acquire Worldpay in Three-Way Deal – Akin Gump, accessed on January 22, 2026, https://www.akingump.com/en/insights/tax-insights/global-payments-to-acquire-worldpay-in-three-way-deal

- Elliott builds stake in Global Payments as Worldpay deal sparks turmoil, accessed on January 22, 2026, https://paymentsindustryintelligence.com/elliott-builds-stake-in-global-payments-as-worldpay-deal-sparks-turmoil/

- Global Payments Stock Jumps On Reports Of Elliott Management Stake – Baystreet.ca, accessed on January 22, 2026, https://baystreet.ca/techinsider/5108/Global-Payments-Stock-Jumps-On-Reports-Of-Elliott-Management-Stake

- Worldpay and Trulioo Collaborate to Embed Trust in the Agentic Commerce Era, accessed on January 22, 2026, https://corporate.worldpay.com/news-releases/news-release-details/worldpay-and-trulioo-collaborate-embed-trust-agentic-commerce/

- Global Payments Announces Board Additions to Enhance Shareholder Value Creation, accessed on January 22, 2026, https://investors.globalpayments.com/news-events/press-releases/detail/487/global-payments-announces-board-additions-to-enhance

- Worldpay to Unlock New Commerce Channels for Merchants with OpenAI Agentic Commerce Protocol, accessed on January 22, 2026, https://corporate.worldpay.com/news-releases/news-release-details/worldpay-unlock-new-commerce-channels-merchants-openai-agentic/

- Global Payments (NYSE: GPN) Closes Worldpay Acquisition and Issuer Solutions Divestiture – Stock Titan, accessed on January 22, 2026, https://www.stocktitan.net/sec-filings/GPN/8-k-global-payments-inc-reports-material-event-20e6636227e8.html

- Global Payments Completes Acquisition of Worldpay and Divestiture of Issuer Solutions Business, Creating Leading Pure-Play Commerce Solutions Provider, accessed on January 22, 2026, https://investors.globalpayments.com/news-events/press-releases/detail/498/global-payments-completes-acquisition-of-worldpay-and

- SWIFT gpi for corporates Cross-border payments, transformed, accessed on January 22, 2026, https://www.swift.com/sites/default/files/documents/swiftgpi_for_corporates_generic_20180503.pdf

- Join the payment innovation leaders | Swift, accessed on January 22, 2026, https://www.swift.com/products/swift-gpi/members

- Revealed: Israel demanded Google and Amazon use secret ‘wink’ to sidestep legal orders | US news | The Guardian, accessed on January 22, 2026, https://www.theguardian.com/us-news/2025/oct/29/google-amazon-israel-contract-secret-code

- IXOPAY and Riskified Announce Partnership to Boost Fraud Prevention and Enhance Enterprise Payment Orchestration, accessed on January 22, 2026, https://www.riskified.com/press/ixopay-and-riskified-announce-partnership-to-boost-fraud-prevention-and-enhance-enterprise-payment-orchestration/

- Pro-Israel billionaires spent over $1.5 million in 38 days to oust Thomas Massie, accessed on January 22, 2026, https://www.denvergazette.com/2025/08/12/pro-israel-billionaires-spent-over-1-5-million-in-38-days-to-oust-thomas-massie-3d094aac-b638-5d86-b05c-2803a38d8401/